The Facts About Offshore Trust Services Uncovered

Wiki Article

Offshore Trust Services for Beginners

Table of ContentsGetting My Offshore Trust Services To Work5 Easy Facts About Offshore Trust Services DescribedThe Of Offshore Trust ServicesAll about Offshore Trust ServicesGetting The Offshore Trust Services To WorkThe Single Strategy To Use For Offshore Trust ServicesThings about Offshore Trust ServicesOffshore Trust Services for Dummies

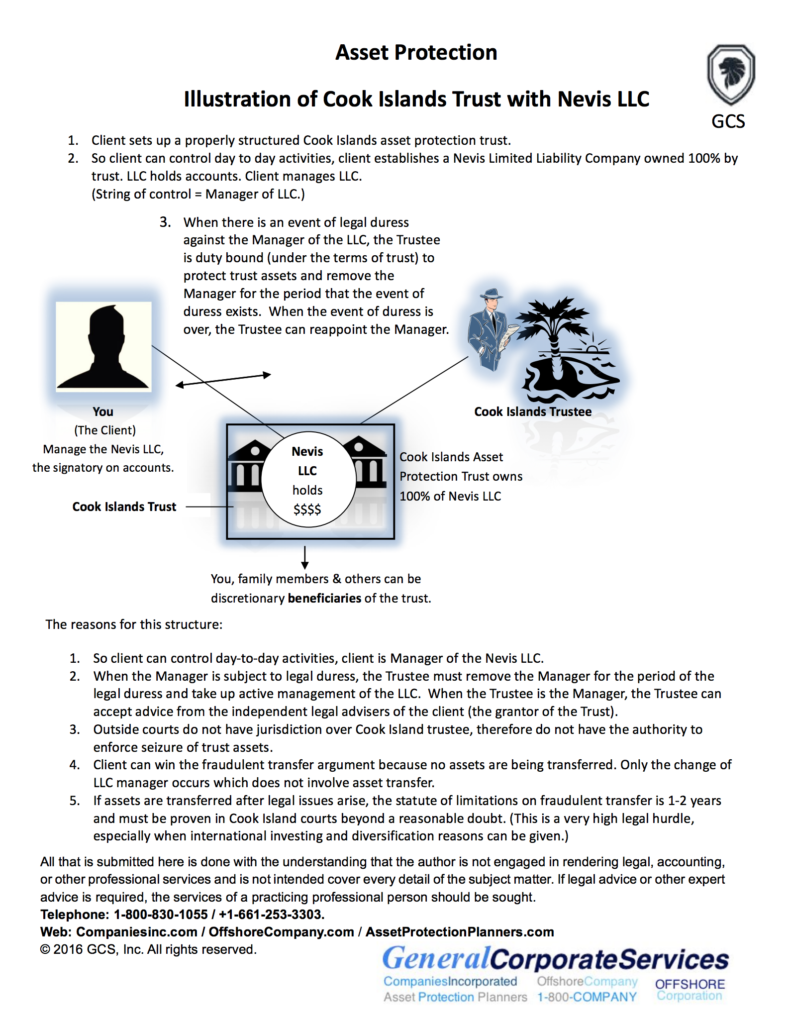

Personal creditors, even larger private firms, are more amendable to settle collections against debtors with complex as well as effective property defense plans. There is no possession defense plan that can deter an extremely encouraged lender with endless money and persistence, however a well-designed offshore depend on commonly offers the debtor a desirable settlement.Offshore depends on are not for every person. For some individuals dealing with hard creditor troubles, the offshore count on is the finest alternative to protect a considerable quantity of assets.

Borrowers may have extra success with an overseas count on plan in state court than in an insolvency court. Judgment financial institutions in state court litigation may be intimidated by offshore property defense trust funds as well as might not seek collection of properties in the hands of an offshore trustee. State courts lack jurisdiction over offshore trustees, which means that state courts have restricted treatments to order compliance with court orders.

Facts About Offshore Trust Services Uncovered

An insolvency borrower should surrender all their assets and lawful passions in residential or commercial property wherever held to the bankruptcy trustee. An U.S. personal bankruptcy judge might oblige the personal bankruptcy borrower to do whatever is needed to transform over to the personal bankruptcy trustee all the borrower's assets throughout the world, including the debtor's advantageous rate of interest in an overseas trust fund.Offshore possession protection counts on are much less reliable versus IRS collection, criminal restitution judgments, as well as household support obligations. The courts might attempt to urge a trustmaker to liquify a trust or bring back trust properties.

The trustmaker must agree to surrender lawful rights and control over their trust fund properties for an offshore count on to successfully secure these properties from U.S. judgments. 6. Choice of a professional and also trustworthy trustee that will certainly protect an overseas count on is extra essential than selecting an offshore count on territory.

Everything about Offshore Trust Services

Each of these nations has count on laws that are beneficial for overseas possession protection. There are refined legal differences amongst overseas trust fund jurisdictions' legislations, but they have a lot more attributes in usual.

Authorities data on counts on are tough to come by as in most offshore territories (and also in most onshore jurisdictions), trusts are not needed to be registered, however, it is thought that the most usual usage of offshore trusts is as part of the tax as well as monetary planning of rich individuals as well as their family members.

Offshore Trust Services Can Be Fun For Everyone

In an Unalterable Offshore Depend on may not be changed or sold off by the settlor. A makes it possible for the trustee to choose the circulation of revenues for different courses of beneficiaries. In a Set trust, the circulation of earnings to the recipients is taken care of and can not be altered by trustee.Privacy as well as anonymity: Although that an offshore trust is formally registered in the government, the events of the count on, properties, as well as the problems of the depend on are not tape-recorded in the register. Tax-exempt standing: Assets that are moved to an overseas trust (in a tax-exempt overseas zone) are not tired either when moved to the trust fund, or when moved or redistributed to the beneficiaries.

Not known Incorrect Statements About Offshore Trust Services

This has actually also been performed in a number of U.S. states. Counts on in basic go through the regulation in which provides (briefly) that where trust fund home consists of the shares of a business, after that the trustees must take a positive function in the events on the company. The rule has been criticised, but continues to be part of trust fund legislation in numerous common legislation territories.Paradoxically, these specialised kinds of trusts seem to rarely be made use of in connection to their initial desired usages. STAR trusts seem to be made use of extra frequently by hedge funds forming mutual funds as unit counts on (where the fund managers desire to eliminate any kind of responsibility to attend meetings of the firms in whose safeties they spend) and click reference also VISTA trust funds are regularly used as a component of orphan structures in bond issues where the trustees wish to divorce themselves from monitoring the providing lorry.

An overseas trust is a device used for asset defense and estate planning that functions by transferring properties right into the control of a lawful entity based in another nation. Offshore trust funds are irrevocable, so trust owners can't redeem ownership of transferred possessions.

A Biased View of Offshore Trust Services

Being offshore includes a layer of protection as well as personal privacy along with the capability to take care of tax obligations. For instance, since the trusts are not situated in the United States, they do not need to adhere to united state regulations or the judgments of united state courts. This makes it harder for lenders as well as litigants to seek insurance claims against assets kept in overseas counts on.It can be challenging for 3rd parties to establish the possessions and owners of overseas depends on, which makes them aid to personal privacy. In order to establish an offshore trust, the primary step is to choose an international nation in which to situate the trust funds. Some prominent places include Belize, the Cook Islands, Nevis and also Luxembourg.

5 Easy Facts About Offshore Trust Services Described

Move the properties that are to be protected into the count on - offshore trust services. Offshore trust funds can be beneficial for estate planning and property defense but they have limitations.residents who establish offshore trusts can not escape all taxes. Revenues by properties put in an offshore trust are devoid of united state taxes. United state people who get circulations as beneficiaries do have to pay United state earnings tax obligations on the circulations. United state proprietors of offshore trust funds also need to file records with the Internal Profits Solution.

Read Full Report

9 Simple Techniques For Offshore Trust Services

Corruption can be an issue in some countries. Additionally, it is essential to choose a country that is not likely to experience political unrest, program change, financial turmoil or rapid changes to tax policies that could make an offshore depend on much less helpful. Possession security depends on generally have to be developed before they are required.They also don't completely shield against all cases as well as might reveal owners to dangers of corruption as well as political instability in the host nations. Offshore Recommended Site depends on are helpful estate planning and also possession security tools. Comprehending the appropriate time to make use of a particular trust fund, as well as which count on would certainly give the most profit, can be confusing.

Think about using our resource on the trusts you can make use of to benefit your estate planning., i, Stock. com/scyther5, i, Supply. com/Andrii Dodonov. An Offshore Depend on is a traditional Trust formed under the legislations of nil (or reduced) tax obligation International Offshore Financial. A Trust fund is a legal tactical plan (similar to a contract) wherein one person (called the "Trustee") according to a subsequent individual (called the "Settlor") grant recognize and hold the residential property to aid various people (called the "Beneficiaries").

Report this wiki page